tax benefit rule state tax refund

Enter the refund as income then back it out As. All or part of the refund must be reported as income on Line 10 of.

Acct 440 Welcome To Taxation Of Business Entities Dr Efrat Ppt Download

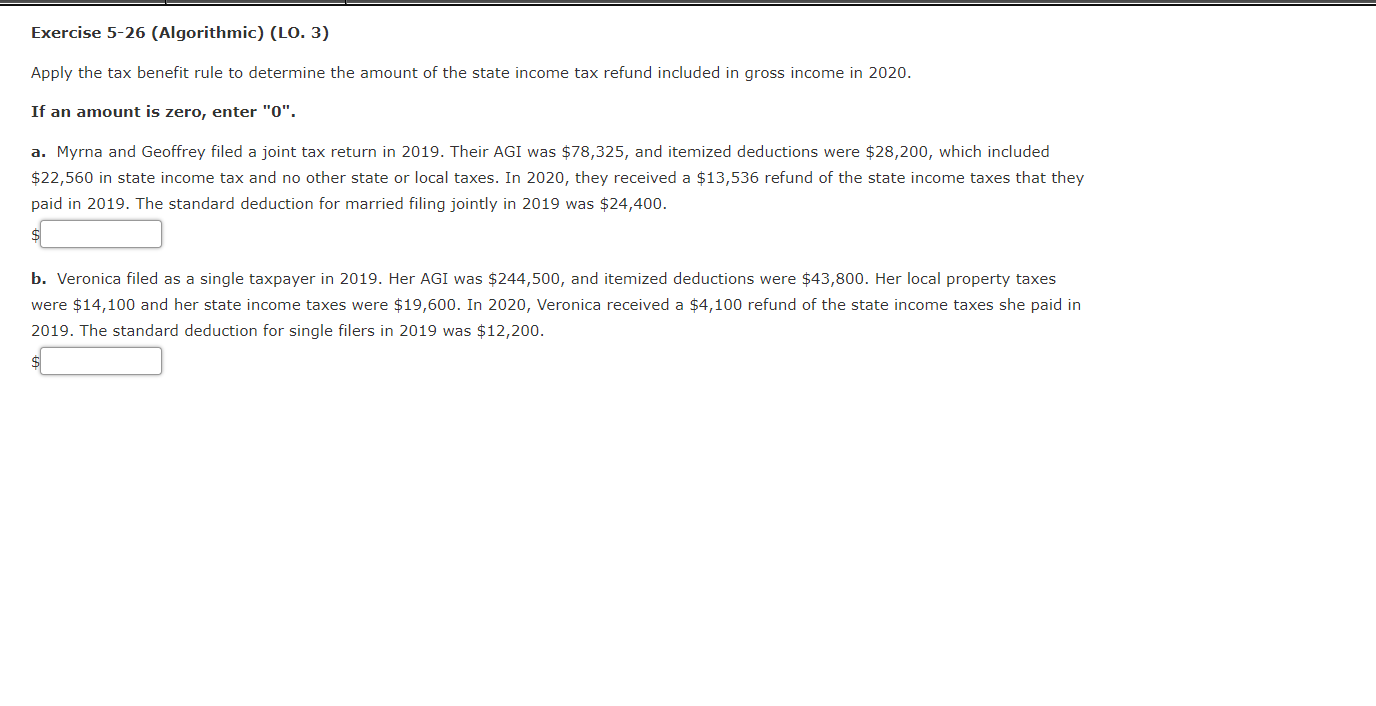

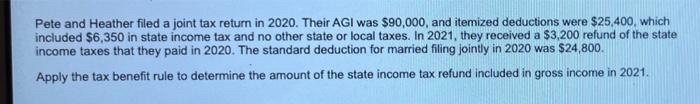

Their AGI was 96325 and itemized deductions were 29300 which included 7325 in state income tax and no other state or local.

. Refunds of amounts deducted on a 1040 -- usually these are state income tax refunds but they can be refunds of other taxes or other expenses like medical -- are not. The IRS issued guidance in late 2018. A tax benefit also includes.

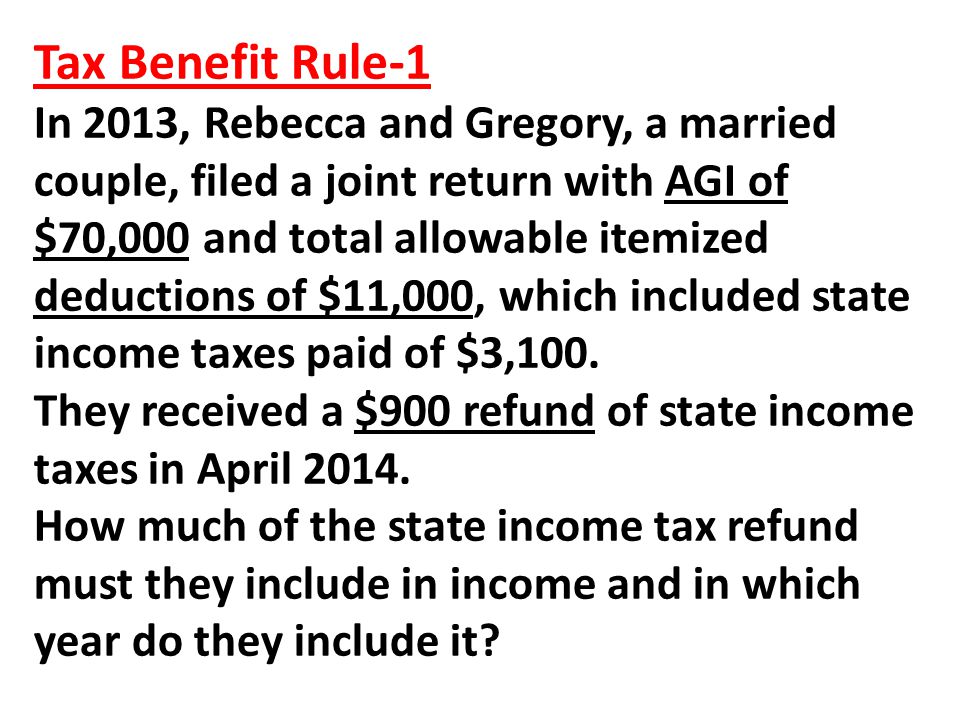

If there is a difference. Many taxpayers are over-withheld for state tax and end up receiving state tax refunds and many people are subject to AMT. A rule that provides that the amount of an expense recovered must be included in income in the year of the recovery to the extent the original expense resulted in a tax benefit.

A tax benefit is interpreted broadly and includes any exclusion deduction or credit which reduced federal income tax due in a prior year. When the couple paid the excess refund 400 to. State tax refunds are only SOMETIMES taxable on the 1040.

The 10000 limit on deduction of state and local taxes SALT has been controversial since its enactment as part of the Tax Cuts and Jobs Act TCJA. When you filed your 2012 state income tax return you were entitled to a refund of 300 which you received. It shouldnt but it is not programmed like the 1040.

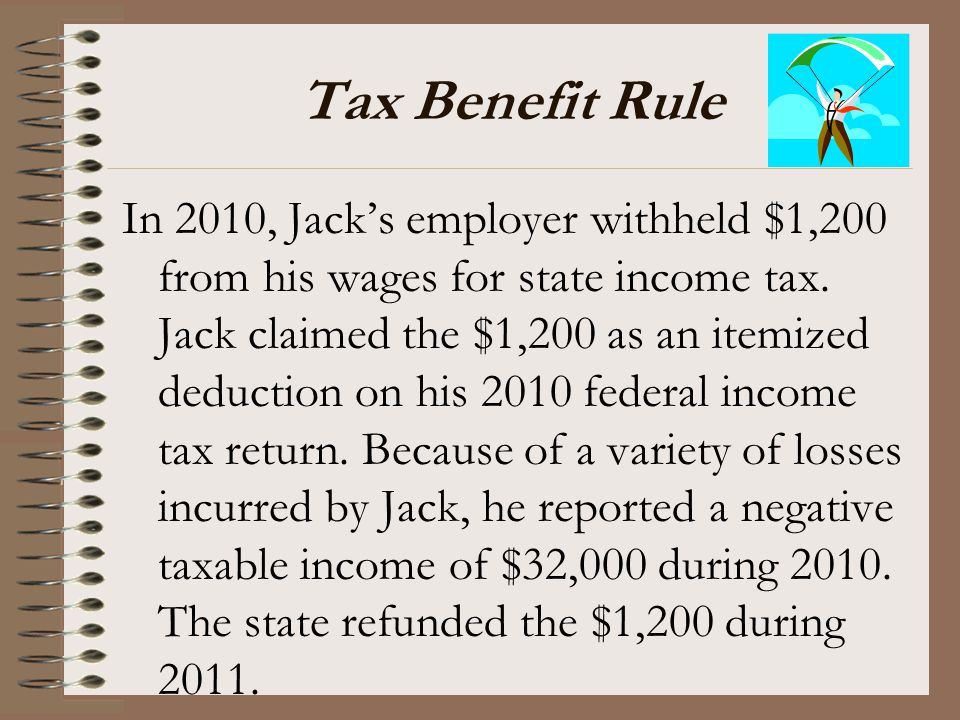

Myrna and Geoffrey filed a joint tax return in 2021. If the total tax on the newly recalculated return is more than the actual filed return some benefit was received and some of the refund may be taxable. Basically the rule are set such that you cant game the system by taking a big deduction on state taxes overpaid in.

If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750. Heres some federal tax lingo.

This situation is quite common. One common source that is frequently overlooked by tax advisors and more often misunderstood is the application of the tax benefit rule IRC section 111 to state and local tax. However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the deduction taken for the refunded amount reduced tax in the.

Solved Exercise 5 26 Algorithmic Lo 3 Apply The Tax Chegg Com

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Here S When Married Filing Separately Makes Sense Tax Experts Say

61 Gross Income General Concepts And Interest Flashcards Quizlet

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

How To Deduct Stock Losses From Your Taxes Bankrate

What Is The Tax Benefit Rule Thestreet

Chapter 8 Income Taxation Of Individuals Exemptions Ppt Download

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Income Tax Rules Committee Meeting Agenda Monday April 16 2012

Received Jobless Benefits In 2020 Irs Could Be Sending You Money Soon

1040 2021 Internal Revenue Service

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Answered Apply The Tax Benefit Rule To Determine Bartleby

:max_bytes(150000):strip_icc()/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png)

Is Your State Tax Refund Taxable

State And Local Tax Salt Deduction Salt Deduction Taxedu